Vancouver, British Columbia – (January 14th, 2025) – Battery Mineral Resources Corp. (TSXV: BMR) ("Battery" or “BMR” or the "Company") is pleased to announce encouraging drill core assay results from the new 2024 underground exploration and in-fill drill program at the Punitaqui mine complex (“Punitaqui”) in Chile.

Highlights

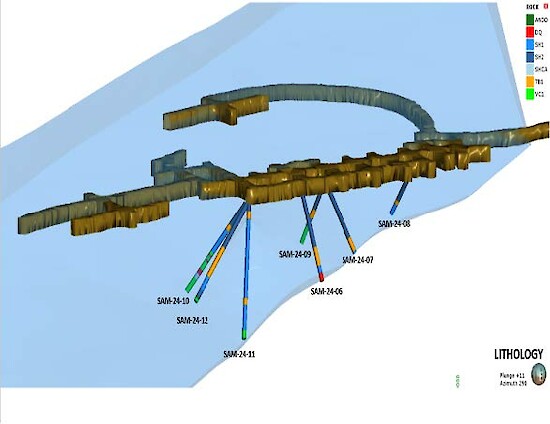

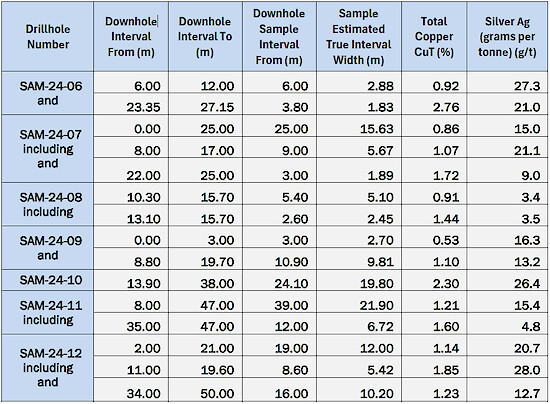

- Assay results from drillholes SAM-24-06, 07, 08, 09,10, 11 and 12 (see Table 1 and Figure 1) have returned with encouraging results as follows:

- SAM-24-06: 2.9 meters (“m”) at 0.92% (“CuT”) total copper and 27.3 g/t grams per tonne (“Ag”) silver and 1.8m at 2.76% CuT & 21.0g/t Ag

- SAM-24-07: 15.6m grading 0.9% Cu & 15.0g/t Ag

- SAM-24-08: 5.1m at 0.9% CuT & 3.4g/t Ag

- SAM-24-09: 9.8m at 1.1% CuT & 13.2g/t Ag

- SAM-24-10: 19.8m at 2.3% CuT & 26.4g/t Ag

- SAM-24-11: 21.9m at 1.2% CuT & 15.4g/t Ag

- SAM-24-12: 12.0m at 1.1% CuT & 20.7g/t Ag and 10.2m at 1.2% CuT and 12.7g/t Ag

(Note: All Intercepts reported as estimated true widths intervals.)

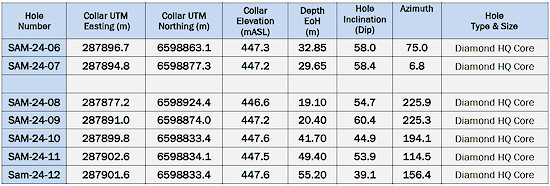

- This San Andres drilling targeted a planned production area and totaled 248.3 meters of diamond core drilling in 7 drillholes (see Table 2 and Figure 1). This program was designed to confirm the modelled geology, mineralization and copper grade within the planned extraction area.

- Sample assay results, reported herein, are from the seven underground drillholes completed on Level 448 at San Andres. All holes begin in the upper shale horizon and drill down stratigraphy into the andesitic rocks underlying the mineralized sedimentary sequence.

- All holes reached target depth and have intersected the targeted shale horizons that host the copper mineralization. This drilling confirmed copper grades and better delineated the extent of the mineralization in the upper and lower shale units within and adjacent to the planned extraction area.

- These drill results have been added to the three-dimensional geology and resource models which BMR’s mining engineers will use to update stope designs and optimize mining plans.

Battery Vice President Exploration Peter Doyle states: “This drilling confirmed the copper grades which exist in the current geological model and better delineated the extent of the mineralization. We believe these new results demonstrate that our understanding of the geological controls of mineralization. The SAM-24-O6 and SAM-24-07 drilling has confirmed a fault offset of the lower shale which represents a new target east of the fault for future drilling.”

During the current operational ramp-up period, the underground drilling program is focused on accessible targets within existing Inferred Resource to upgrade the resources to a higher resource category as well as targeting areas adjacent to Inferred Resource to potentially add new resources.

The 2024 drill plan allowed for some flexibility in terms of timing and sequencing of target areas with the drilling being shifted between the Cinabrio mine and the adjacent San Andres underground.

Details of New Holes

Drillhole SAM-24-06: was designed to test the down-dip extension “Targeted Stratigraphic Unit” (“TSU”) below level 448. The hole began in the upper part of the TSU and bottomed in the footwall andesite. The hole intersected the upper shale unit between 0m – 18.3m. Copper intercepts in the upper unit include 2.9m at 0.92% CuT & 27.3g/t Ag. The lower shale unit was intersected between 23.4m - 27.2m and returned 1.8m grading 2.76% CuT & 21.0g/t Ag. This lower intersection is bornite-rich and mineralized sediments are cut off by a fault. The results confirm both the down-dip extension of the mineralization and the modelled geology within the central part of the planned extraction area. The fault offset of the lower shale unit represents a new exploration target that will be tested.

Drillhole SAM-24-07 targeted the down-dip extension of the TSU below level 448. The hole began in the upper part of the TSU and bottomed in the footwall andesite. The hole intersected the upper shale unit between 0m – 18.6m. Copper intercepts in the upper unit include 5.7m grading 1.1% CuT & 21.1.0g/t Ag. The lower shale unit was intersected between 23.2m - 24.6 m and returned an intersection of 1.9m at 1.7% CuT & 9.0g/t Ag.

This hole like drillhole SAM-24-06, the lower shale intersection is bornite-rich, and the mineralized sediments are cut off by a fault intersected at a depth of 24.6 meters which is interpreted to be the same fault which cut off the lower shale unit in drill hole SAM-24-06. The location of this offsetting fault is now well constrained and future drill holes will test the TSU east of this fault.

Drillhole SAM-24-08 tested the TSU below level 448 to the north of planned extraction area. The hole started in the upper part of the TSU and bottomed in the footwall andesite, crossing the TSU at an angle close to perpendicular. The hole intersected a weakly mineralized upper shale unit between 0m – 10.5m. From 10.3m to 12.0m the hole intersected a tuff breccia unit which separates the upper and lower shale units. The lower shale unit was intersected between 12.0m - 15.7m. A mineralized intercept in the lower unit returned 2.5m at 1.44% CuT & 3.5g/t Ag.

Drillhole SAM-24-09 targeted the TSU 21m meters up-dip from SAM-24-06. The hole started in the upper part of the TSU and bottomed in the footwall andesite, crossing the TSU at an angle close to perpendicular. The hole intersected a variably mineralized upper shale unit between 0m and 6.8m. The lower shale unit was intersected between 8.8m - 14.3m and a volcanoclastic unit from 14.3m - 19.7m. Both the lower shale and the volcanoclastic units are mineralized. The intercept across these units in SAM-4-09 yielded 9.8m at 1.1% Cu and 13.2g/t Ag

Drillhole SAM-24-10 was designed to test the TSU within the southern part of the planned extraction area. The hole began in the upper part of the TSU and bottomed in the footwall andesite. It intersected the upper shale unit with minor copper mineralization between 0m – 10.2m. A tuff breccia intercalated with minor shales and volcanoclastics was intercepted from 10.2m to 17.7m. The lower shale horizon was intersected between 17.7m - 35.4m. Mineralization within the lower part of the tuff breccia/volcanoclastic unit and the lower shale horizon returned 19.8m of 2.3% CuT and 26.4g/t Ag. This intercept has confirmed the modelled geology and better delineated the grade and extent of the copper mineralization.

Drillhole SAM-24-11 targeted the TSU within the southern part of the planned extraction area 30m down-dip from SAM-24-10. The hole started in the upper part of the TSU and bottomed in the footwall andesite. It intersected the upper shale unit with minor copper mineralization between 0m – 10.2m. From 10.2m - 17.7m the section drilled consisted of a tuff breccia intercalated with minor shale beds and abundant volcanoclastics in the lower part. The lower shale horizon was intersected between 17.7m - 38.3m. Mineralization occurs within the lower part of the tuff breccia/volcanoclastic unit, the lower shale horizon and in the lower volcanoclastic unit. Assay results returned 21.9m at 1.2% CuT and 15.4g/t Ag including 6.7m at 1.6% CuT and 4.8g/t Ag.

Drillhole SAM-24-12 tested the TSU within the southern part of the planned extraction area south of SAM-24-10 and SAM-24-11. The hole began in the upper part of the TSU and bottomed in the footwall andesite. It intersected the upper shale unit between 0m – 20.1m; The section cut from 20.1m - 32.2m a tuff breccia intercalated with volcanoclastics. The lower shale horizon was intersected between 32.2m and 38.1m. Volcanoclastics were intersected between 38.1m - 52.9m. Mineralization occurs primarily in the upper and lower shale horizons. Results include 12m at 1.1% CuT and 20.7g/t Ag in the upper shale and 10.2m at 1.23% CuT and 12.7g/t Ag in the lower shale.

Figure 1: San Andres Drilling Hole Location Plan- Level 448

Table 1: San Andres Level 448 Significant Drillhole Intercepts

Note: All Intercepts reported as estimated true widths intervals

Table 2: San Andres Drillhole Summary

Background – San Andres Deposit

The San Andres resource is part of the Punitaqui project which is situated within a 25km long mineralized district that is a classic IOCG and manto style copper belt that is comprised of manto and structural controlled copper-silver veins. San Andres is a zone of manto copper mineralization located 500m southwest of the high-grade Cinabrio deposit.

On October 3, 2022, BMR published an NI 43-101 resource for San Andres at a 0.70 Cu% cut-off.

- Indicated Sulphide Resource of 1,736,000 tonnes grading 1.06% CuT and 4.83 g/t Ag.

- Inferred Sulphide Resource of 303,000 tonnes at 0.82% Cu and 4.03g/t Ag

Note: Scientific and technical information pertaining to the San Andres Resource was extracted from the Company’s NI 43-101 “Technical report on Punitaqui Copper Complex Coquimbo, Chile” dated as of September 30,2022 with an effective date of August 16, 2022, prepared by Garth Kirkham (Kirkham Geosystems Ltd.) an Independent Qualified Person in accordance with NI 43-101.

Quality Control

Sample preparation, analysis and security procedures applied on the BMR exploration projects are aligned with industry best practice. BMR has implemented protocols and procedures to ensure high quality collection and management of samples resulting in reliable exploration assay data. BMR has implemented formal analytical quality control monitoring for all field sampling and drilling programs by inserting blanks and certified reference materials into every sample sequence dispatched.

Sample preparation is performed BMR Los Mantos Preparation Lab. Samples are dried then crushed to 70% < -2 millimeters and a riffle split of 250 grams is then pulverized to 85% of the material achieving a size of <75 microns. Sample pulps & rejects were then delivered to ALS Global - Geochemistry Analytical Lab in La Serana, Chile and sample analyses by ALS in Lima, Peru. ALS analytical facilities are commercial laboratories and are independent from BMR. All BMR samples are collected and packaged by BMR staff and delivered upon receipt at the ALS Laboratory. Samples are logged in a sophisticated laboratory information management system for sample tracking, scheduling, quality control, and electronic reporting. These prepared samples are then shipped to the ALS Laboratory in North Vancouver for analyses by the following methods:

- ME-MS61: A high precision, multi-acid digest including Hydrofluoric, Nitric, Perchloric and Hydrochloric acids. Analysed by inductively coupled plasma (“ICP”) mass spectrometry that produces results for 48 elements.

- ME-OG62: Aqua-Regia digest: Analysed by ICP-AES (Atomic Emission Spectrometry) or sometimes called optical emission spectrometry (ICP-OES) for high levels of Co, Cu, Ni and Ag.

Certified standards are inserted into sample batches by ALS. Blanks and duplicates are inserted within each analytical run. The blank is inserted at the beginning, certified standards are inserted at random intervals, and duplicates are analysed at the end of the batch.

Qualified Persons

Peter Doyle, Vice President of Exploration and Michael Schuler, Chile Exploration Manager for Battery Mineral Resources Corp., supervised the preparation of and approved the scientific and technical information in this press release pertaining to the Punitaqui exploration drill program. Mr. Doyle and Mr. Schuler are qualified persons as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Scientific and technical information pertaining to the Punitaqui Resource was extracted from the Company’s NI 43-101 “Technical Report on Punitaqui Copper Complex Coquimbo, Chile” dated as of September 30,2022 with an effective date of August 16, 2022, prepared by Garth Kirkham (Kirkham Geosystems Ltd.) an Independent Qualified Person in accordance with NI 43-101.

All mineral resources have been estimated in accordance with Canadian Institute of Mining and Metallurgy and Petroleum (“CIM”) definitions, as required under NI 43-101. Cut-off grades are based on a price of US$3.50/lb copper, US$20/oz silver and several operating costs, metallurgical recoveries, and recovery assumptions, including a reasonable contingency factor.

About Battery Mineral Resources Corp.

Battery Mineral Resources’ mission is to build a mid-tier copper producer and has recently initiated mine and mill operations at the Punitaqui Mining Complex, a historic copper-gold-silver producer, in the Coquimbo region of Chile. The Company’s portfolio also consists of two cobalt assets and one lithium asset located in North America and two graphite assets in South Korea. The Company is focused on providing shareholders accretive exposure to copper and the global mega-trend of electrification while being focused on growth through cash-flow, exploration, and acquisitions in favorable mining jurisdictions.

For more information about Battery Minerals, please visit our website at, https://bmrcorp.com or email us at info@bmrcorp.com.

Battery Mineral Resources Corp.

Martin Kostuik, CEO

Phone: +1 (604) 628-1110

Twitter: @BMRcorp_

Facebook: Battery Mineral Resources Corp. | Facebook

LinkedIn: Battery Mineral Resources Corp.: My Company | LinkedIn

Forward Looking Statements

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections of the Company on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, the ability of the Company to obtain sufficient financing to complete exploration and development activities, risks related to share price and market conditions, the inherent risks involved in the mining, exploration and development of mineral properties, government regulation and fluctuating metal prices. Accordingly, readers should not place undue reliance on forward-looking statements. Battery undertakes no obligation to update publicly or otherwise revise any forward-looking statements contained herein whether as a result of new information or future events or otherwise, except as may be required by law.