Vancouver, British Columbia – (April 22, 2021) – Battery Mineral Resources Corp. (TSXV: BMR) ("Battery" or “BMR” or the "Company") is pleased to announce that it has successfully defined a cobalt mineral resource of over 1 million pounds for the McAra Cobalt deposit.

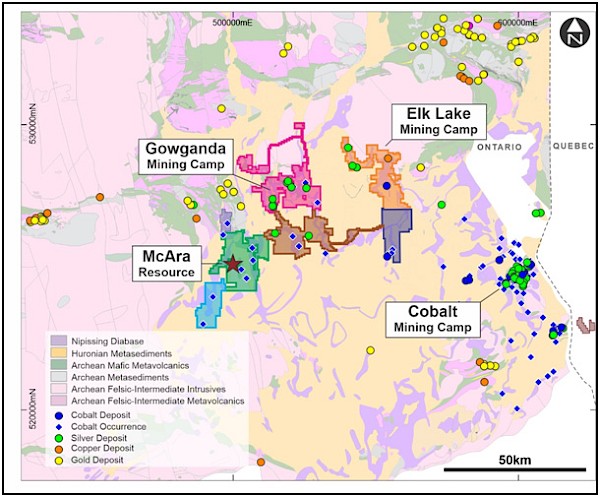

The McAra Cobalt mineral resource is located 150 km northeast of Sudbury, Ontario and is the first new cobalt dominant mineral resource delineated in the region in the past 50 years. The resource is hosted in the Cobalt Embayment (see Figure 1). The Cobalt Embayment hosts over 70 cobalt-silver deposits that collectively produced 525 million ounces of silver and 50 million pounds of cobalt from high grade five element (Ag–Co–Ni–Bi–As) veins in the Cobalt, Gowganda and Elk Lake Mining Camps.

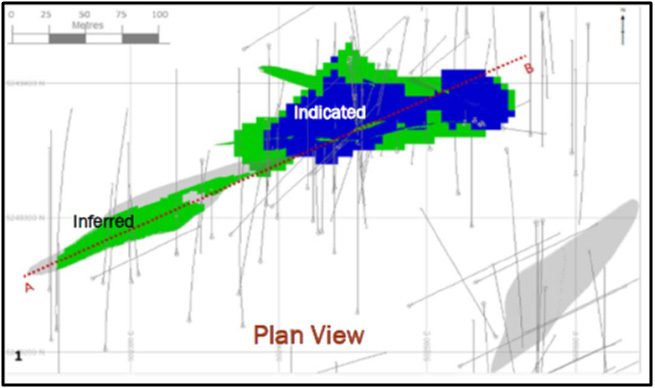

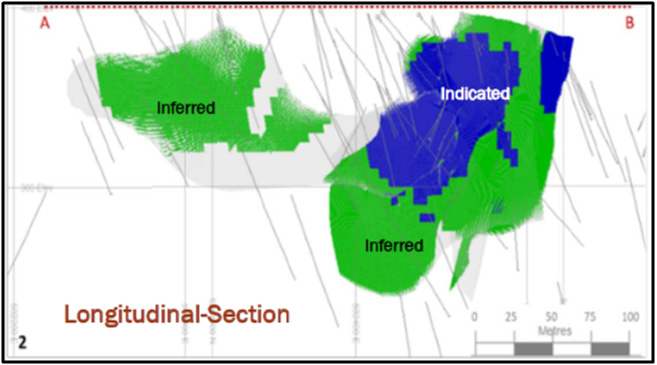

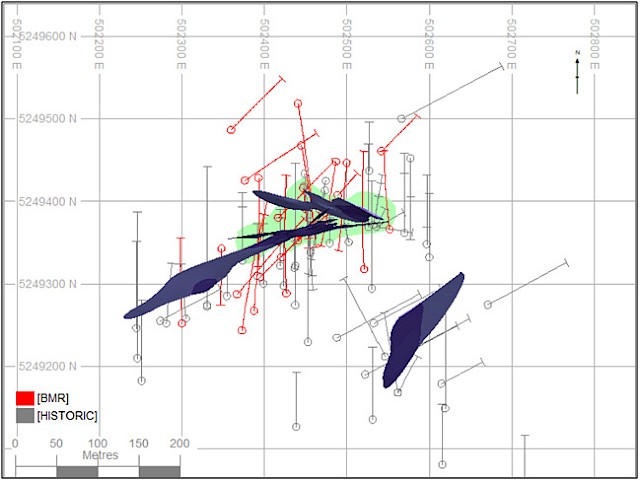

After acquiring the property in February 2017, BMR launched a multi-faceted exploration program that included geophysical surveys, geochemical sampling and a series of diamond drill programs (56 holes totaling 10,486 m) to define a NI 43-101 compliant Measured and Indicated resource of 1,124,000lbs Co-Eq that includes 1,102,000 pounds of cobalt and & 11,260 ounces of silver (See Table 1, Figures 2 & 3 and Photo 1).

Table 1 : Mineral Resource Statement*, McAra Project SRK Consulting (Canada) Inc.

| Category | Quantity (000' t) |

Grade | Metal | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cobalt Percent (%) |

Silver grams /tonne (g/t) |

Co-Eq* Percent (%) |

Cobalt Pounds (lbs) |

Silver Ounces (oz) |

Co-Eq* Pounds (lbs) |

|||||||||||||||||||||||

| Measured and Indicated** | 34 | 1.47 | 10.28 | 1.50 | 1,102,000 | 11,260 | 1,124,000 | |||||||||||||||||||||

| Inferred | 5 | 1.94 | 10.84 | 1.96 | 214,000 | 1,650 | 216,000 | |||||||||||||||||||||

|

Mineral resources are not mineral reserves and have not demonstrated economic viability. All figures are rounded to reflect the relative accuracy of the estimate. All composites have been capped where appropriate.

|

||||||||||||||||||||||||||||

Battery CEO Martin Kostuik states; “We are excited that this historic discovery at McAra has become a primary cobalt mineral resource. It is the first of its kind in region, for this highly strategic metal, in almost 50 years. It is not surprising given that it is located in Ontario’s prolific Cobalt Embayment between the past producing mining camps at Cobalt and Gowganda. The one-million-plus pound cobalt mineral resource outlined by BMR drilling is part of a regionally extensive and highly prospective land package of nearly 120,000 hectares, that may host additional high-grade deposits as our ongoing exploration program progresses. This could become a part of a series of feed sources for a potential cobalt ore processing facility in the region.”

Figure 1: Cobalt Embayment Geology, BMR Claim Holdings and McAra Resource Location Plan

Exceptionally high-grade cobalt was intercepted during the McAra mineral resource definition and exploration drilling as tabulated in Table 2.

Table 2: Cobalt Assays above 1% from the McAra deposit and associated silver values

| Hole Number |

From (metres) | To (metres) |

Sample Interval (metres) |

Cobalt (Co) Percent (%) |

Silver (Ag) Grams per Tonne (g/t) |

|---|---|---|---|---|---|

| MCD19047 | 152.26 | 153.20 | 0.94 | 13.20 | 32.30 |

| MCD19043 | 94.90 | 95.87 | 0.97 | 12.50 | 109.00 |

| MCD17005 | 68.50 | 69.00 | 0.50 | 12.40 | 559.00 |

| MCD17009 | 101.30 | 102.00 | 0.70 | 9.83 | 21.00 |

| MCD18028 | 163.40 | 164.00 | 0.60 | 5.97 | 33.2 |

| MCD19046 | 58.34 | 59.00 | 0.66 | 4.63 | 12.70 |

| MCD17018 | 59.00 | 60.00 | 1.00 | 3.83 | 5.98 |

| MCD17004 | 42.85 | 43.60 | 0.75 | 3.42 | 4.93 |

| MCD18030 | 127.70 | 128.30 | 0.60 | 3.40 | 4.25 |

| MCD17002 | 145.30 | 146.30 | 1.00 | 3.03 | 11.35 |

| MCD17012 | 100.40 | 101.00 | 0.60 | 2.58 | 19.65 |

| MCD17001 | 67.80 | 68.30 | 0.50 | 2.54 | 3.06 |

| MCD19044 | 103.50 | 103.63 | 0.13 | 2.01 | 37.00 |

Photo 1: Sample of Cobaltite Rich Sulphide Vein Breccia from McAra Surface Outcrop

Figure 2: Mcara Mineral Resource Plan View Showing Informing Drilling - SRK Consulting (Canada) Inc. (2021)

Figure 3: McAra Mineral Resource Longitudinal Section Along the Section A-B Showing Informing Drilling - SRK Consulting (Canada) Inc. (2021)

Background

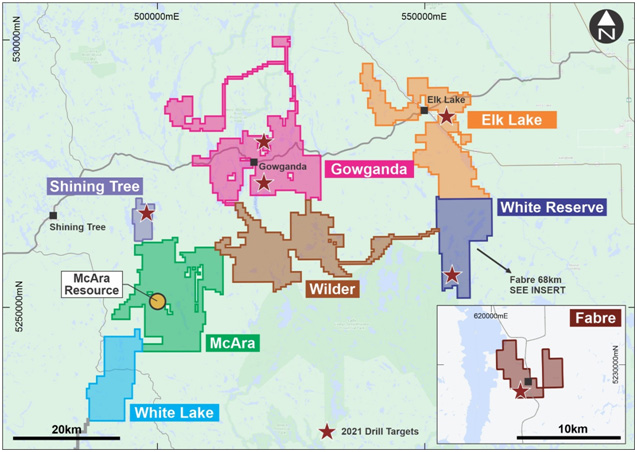

Between 2016 – 2018 BMR acquired a large portfolio of cobalt-silver properties in Ontario and Quebec through a series of direct purchases, options, joint ventures and/or staked claims. The current exploration portfolio comprises a total of 6,327 Ontario claims (for 118,890 hectares) and 31 Quebec claims (for 1,813 hectares). The BMR assets also include 9 leases (for 658 hectares). The total area occupied by all BMR assets in Ontario is 119,548 hectares 1,195 square kilometres) and 1,813 hectares (18.1 square kilometres) in Quebec.

The majority of BMR ‘s land holdings are situated west of the historic silver-cobalt mining town of Cobalt and north of Sudbury. This area, known as the Cobalt Embayment, is the historic home of silver-cobalt exploration and mining in Canada. Much of the Exploration and development that occurred in the last century primarily focused on silver with bi-product cobalt. The region hosts multiple high-grade cobalt and silver targets. Conceptually, the Company is looking to delineate a number of resources as a “hub & spoke” type development around a centralized processing plant at Gowganda or Elk Lake.

The McAra Project comprises 1,232 mining claims and 1 mining lease covering 25,187 hectares (252km2) in a single block situated in the townships of Dufferin, Leckie, Leith, Leonard, North Williams and Ray.

Figure 4: BMR’s land position in the Cobalt Embayment

Mineral Resource Estimation

The following summary of the McAra mineral resource estimation procedure is extracted from the NI 43-101 “Technical report on Cobalt Exploration Assets in Canada” dated as of May 26, 2020 with an effective date of March 31, 2020, prepared by SRK Consulting (“SRK”).

The mineral resource evaluation methodology involved the following procedures:

- Database compilation and verification.

- Construction of wireframe models for the boundaries of the cobalt, silver, and copper mineralization.

- Definition of resource domains.

- Data conditioning (compositing and capping) for geostatistical analysis and variography.

- Block modelling and grade interpolation.

- Resource classification and validation.

- Assessment of “reasonable prospects for eventual economic extraction” and selection of appropriate cut-off grades.

- Preparation of the Mineral Resource Statement.

Mineral Resource Database

BMR provided a drillhole database to SRK as Excel format files on August 27, 2019, following a site visit by Dr. Lebrun, PGeo and Ms. Protulipac, PGeo from August 26 to 29, 2019, which formed the basis for this mineral resource evaluation. The drilling database was comprised of 128 drillholes, of which 72 were drilled by Wallbridge (WM series) and Liberty Mines (EDS series). A total of 56 Holes were drilled by BMR. For a summary of the available drillholes see Table 3. The effective date of the drilling database was May 1, 2019, representing core from the drilling completed in February 2019.

Table 3: Drilling Database for McAra Project

| Operator | Diamond Drill Core | |||

|---|---|---|---|---|

| Years | Number of Holes | Total Metres | Number of Assays | |

| Historic | 1971-1996 | 39 | 5,207 | 935 |

| Wallbridge Mining | 1997-2001 | 15 | 2,647 | 658 |

| Liberty Mines | 2003-2004 | 18 | 1,580 | 164 |

| BMR | 2017-2019 | 56 | 10,486 | 8,592 |

| Total | - | 128 | 19,920 | 10,349 |

For the BMR drillholes all final collar locations were surveyed with a Trimble differential GPS instrument using UTM coordinates and BMR completed downhole surveys at intervals of 30 metres using the Easy Gyro system. Historic holes have surveys completed every 50 metres on average. Five 2019 BMR drillholes were cored and logged using orientation tools to provide oriented structural measurements. Core recovery was above 95% in the holes logged by BMR.

SRK considered the implication of including the historic drill holes in the estimation. It was found that holes drilled by BMR through the prospect had excellent spatial coverage through the area of interest, and that there was no evidence of bias introduced by including the historic holes in the estimate. The distribution of BMR and historic holes is displayed in Figure 5.

Based on SRK’s review of the available data and site visit completed in August 2019, SRK believes that the drilling, logging, core handling, storage, and analytical quality control protocols used by BMR meet industry best practices outlined in CIM Exploration Best Practices (November 2018). As a result, SRK considers that the exploration data collected by BMR are of sufficient quality to support mineral resource evaluation.

Figure 5: Distribution of Drillholes over the McAra Project Showing Modeled Mineralization Wireframes.

McAra Resources QAQC

SRK analyzed the analytical quality control data produced by BMR for 2017 to 2019 drilling programs for the McAra deposit. All data were provided to SRK in Microsoft Excel spreadsheets accompanied by original pdf lab certificates. SRK aggregated the assay results of the external analytical control samples for further analysis. Control samples (blanks and certified reference materials) were summarized on time series plots to highlight their performance. Paired data for preparation duplicate assays were analyzed using bias charts, quantile-quantile, and relative precision plots.

BMR used a total of 5 certified standard reference material types with a variable range of expected values for the cobalt and VMS mineralization. Overall, the performance of these materials is acceptable with most failures attributed to the mislabelling of standards, and ranging from 0% to 7%, typically below 4%. The custom-made OREAS high-grade cobalt standard exhibited a failure rate of 89% and a consistent low bias throughout the entirety of its use and should be further investigated and potentially replaced. Continued diligence in monitoring quality control data is strongly encouraged.

Paired field duplicate samples performed generally well. Rank half absolute relative difference (HARD) plots suggested that 88.2% of the duplicate assays conducted on core, had HARD below 10%, suggesting good homogeneity of cobalt within core duplicates. Samples grading over 100 ppm cobalt typically exhibited slightly higher grades in the original samples when compared to duplicate samples, suggesting a possible selective bias at the core sampling stage. BMR is encouraged to continue promoting non-biased sampling procedures.

Overall, SRK considers analytical results from core sampling conducted at McAra are globally sufficiently reliable for the purpose of resource estimation. The data examined by SRK do not present other obvious evidence of analytical bias.

Quality Control

Sample preparation, analysis and security procedures applied on the BMR exploration projects is aligned with industry best practice. BMR has implemented protocols and procedures to insure high quality collection and management of samples resulting in reliable exploration assay data. BMR has implemented formal analytical quality control monitoring for all of its field sampling and drilling programs by inserting blanks and certified reference materials into every sample sequence dispatched.

Sample preparation was performed by ALS Minerals Laboratories (ALS) in Sudbury, Ontario and sample analyses by ALS in North Vancouver, British Columbia. ALS analytical facilities are commercial laboratories and are independent from BMR. All BMR samples were bagged by BMR staff and delivered Upon receipt at the ALS Laboratory in Sudbury, samples were logged in a sophisticated laboratory information management system (LIMS) for sample tracking, scheduling, quality control, and electronic reporting. Samples were dried in special drying ovens prior to crushing. The samples were crushed to 70% < -2 mm and a riffle split of 250 grams was then pulverized to 85% of the material achieving a size of <75 microns. These prepared samples were then shipped to the ALS Laboratory in North Vancouver for analyses by the following methods:

- ME-MS61: A high precision, multi-acid digest including Hydrofluoric, Nitric, Perchloric and Hydrochloric acids. Analysed by ICP (inductively coupled plasma) mass spectrometry that produced results for 48 elements.

- ME-OG62: Aqua-Regia digest: Analysed by ICP- AES (Atomic Emission Spectrometry) or sometimes called optical emission spectrometry (ICP-OES) for high levels of Co, Cu, Ni and Ag.

- Ag-GRA21: Silver by fire assay and gravimetric finish; 30-gram charge. Weight. Used when samples contain > 1500 ppm silver.

- Au-AA25: Gold was analysed by a 30-gram fire assay method, followed by AAS (atomic absorption spectroscopy).

Note that 48 element ICP trace element data was also collected and reported by the laboratory. Certified international standards were inserted into sample batches by ALS. Blanks and duplicates are inserted within each analytical run. The blank is inserted at the beginning, internationally certified standards are inserted at random intervals, and duplicates are analysed at the end of the batch.

Qualified Persons

P. J. Doyle, FAusIMM (#208850), Battery Mineral Resources Corp. - Vice President Exploration - Canada, supervised the preparation of and approved the scientific and technical information in this press release pertaining to the Canada Exploration Program. Information about data verification procedures used to support scientific and technical information on the Company’s Canadian properties presented herein, as well as with respect to the results of, processing and interpretation of exploration data.

Scientific and technical information pertaining to the McAra Resource Estimate was prepared by SRK Consulting (Canada) Inc., under the supervision of G Cole PGeo (APGO#1416).

Technical reports filed by the Company under the Company’s profile at www.sedar.com: “Technical Report on Cobalt Exploration Assets in Canada” dated as of May 26, 2020 with an effective date of March 31, 2020, prepared by SRK Consulting – G Cole PGeo (APGO#1416).

About Battery Mineral Resources Corp.

Battery is a multi-commodity resource company. Battery is engaged in the discovery, acquisition, and development of battery metals (cobalt, lithium, graphite, nickel & copper), in North America and South Korea. Battery is the largest mineral claim holder in the historic Gowganda Cobalt-Silver Camp, Canada, with various high-grade primary cobalt silver-nickel-copper targets located in the Cobalt Belt of Ontario and Quebec. In addition, Battery owns approximately 89.2% of ESI Energy Services, Inc., a pipeline equipment rental and sales company with operations in Leduc, Alberta and Phoenix, Arizona. Finally, Battery is currently pursuing a concurrent financing and acquisition to acquire the Punitaqui Mining Complex, a copper-gold mine located in the Coquimbo region of Chile.

For further information, please contact Battery Mineral Resources Corp.:

Martin Kostuik

Phone: +1 (604) 229 3830

Email: mkostuik@bmrcorp.com

Forward Looking Statements

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation, including statements related to the completion of Punitaqui Acquisition, the acquisition of the Xiana Indebtedness or the Offering, the use of the proceeds of the Offering, the potential benefits of such transactions and the likelihood of developing the Punitaqui Mine Complex into a sustainable mid-sized copper producer. Actual future results may differ materially. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections of the Company on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, the ability of the Company to obtain sufficient financing to complete the Punitaqui Acquisition, obtaining all required regulatory approvals necessary to complete the Punitaqui Acquisition and the acquisition of Xiana Indebtedness, risks related to share price and market conditions, the inherent risks involved in the mining, exploration and development of mineral properties, government regulation and fluctuating metal prices. Accordingly, readers should not place undue reliance on forward-looking statements. Battery undertakes no obligation to update publicly or otherwise revise any forward-looking statements contained herein whether as a result of new information or future events or otherwise, except as may be required by law.