Battery Mineral Resources (“BMR”) 100%-owned Punitaqui copper mine operation leverages all necessary fixed assets and infrastructure, excellent road access, ready availability of water, existing power lines, operational permits in place, and widespread mineralization. Punitaqui boasts a nine-plus year operating history.

After acquiring the assets in March 2021, BMR begin redevelopment of the operation and on May 13th, 2024, BMR announced the resumption of copper concentrate production.

The timeline from first fresh mine feed through the mill to reaching planned capacity is expected to require approximately nine months, reaching a run rate of ~90,000 tonnes per month. BMR expects that the Punitaqui full annual copper production rate will be in the range of 19 million to 23 million pounds of copper in concentrate with an operating margin of $35 million to $50 million at current copper prices.

Cinabrio is the original underground mine which was the source of feed to the copper concentrating plant for over eight years and has remaining ore to be processed. The San Andres zone has existing underground access and copper mineralization up to 30 meters wide. The Dalmacia zone also has underground access and exhibits copper mineralization widths up to 50 meters. Regional targets including the Cinabrio Norte zone offer near-term “blue sky” exploration and district-scale potential for BMR.

While the Cinabrio and San Andres mines are reaching full production, BMR will continue processing mill feed from outside sources and advancing toward its newly discovered Cinabrio Norte zone, to commence production of mill feed from that zone in H2 2025.

As part of the ongoing operational readiness during 2024, BMR is executing underground infill and extensional drilling at San Andreas and Cinabrio. The drilling program is designed to further define areas that could be included in near-term mine sequencing and for grade control purposes. BMR looks forward to reporting the results of this drilling during the course of the year.

Battery Mineral Resources (“BMR”) 100%-owned Punitaqui copper mine operation leverages all necessary fixed assets and infrastructure, excellent road access, ready availability of water, existing power lines, operational permits in place, and widespread mineralization. Punitaqui boasts a nine-plus year operating history.

After acquiring the assets in March 2021, BMR begin redevelopment of the operation and on May 13th, 2024, BMR announced the resumption of copper concentrate production.

The timeline from first fresh mine feed through the mill to reaching planned capacity is expected to require approximately nine months, reaching a run rate of ~90,000 tonnes per month. BMR expects that the Punitaqui full annual copper production rate will be in the range of 19 million to 23 million pounds of copper in concentrate with an operating margin of $35 million to $50 million at current copper prices.

Cinabrio is the original underground mine which was the source of feed to the copper concentrating plant for over eight years and has remaining ore to be processed. The San Andres zone has existing underground access and copper mineralization up to 30 meters wide. The Dalmacia zone also has underground access and exhibits copper mineralization widths up to 50 meters. Regional targets including the Cinabrio Norte zone offer near-term “blue sky” exploration and district-scale potential for BMR.

While the Cinabrio and San Andres mines are reaching full production, BMR will continue processing mill feed from outside sources and advancing toward its newly discovered Cinabrio Norte zone, to commence production of mill feed from that zone in H2 2025.

As part of the ongoing operational readiness during 2024, BMR is executing underground infill and extensional drilling at San Andreas and Cinabrio. The drilling program is designed to further define areas that could be included in near-term mine sequencing and for grade control purposes. BMR looks forward to reporting the results of this drilling during the course of the year.

Punitaqui - San Andres

Key Facts

Overview

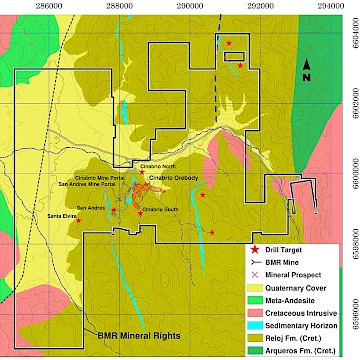

The San Andres target is part of the Punitaqui project which is situated within a 25km long mineralized district that is a classic IOCG and mantos style copper-gold belt that is comprised of mantos and structurally controlled copper-gold-silver veins.

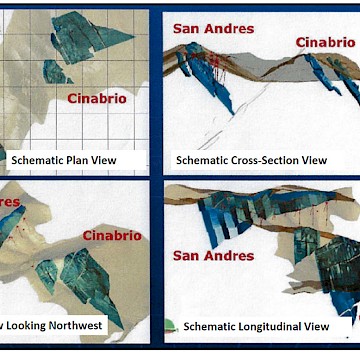

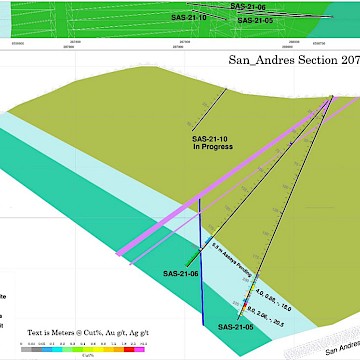

San Andres is a zone of copper mineralization located 500m southwest of the high-grade Cinabrio deposit. San Andres forms a tabular sedimentary horizon within a volcanic sequence. This sedimentary horizon is variably mineralized and has a irregular width extent ranging from 5m - 30m. The horizon dips 40 to 50 degrees to the east and is cut-off at depth by the moderately west dipping San Andres fault.

The mineralisation of predominantly disseminated style consisting of chalcopyrite, bornite and pyrite. Mining infrastructure already established at San Andres include portal access and limited underground development.

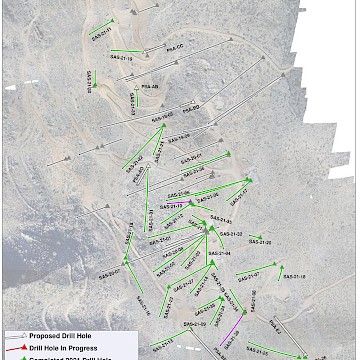

As part of the completed Phase 1 drill program, San Andres saw 8,156m drilled in 38 diamond drill holes by BMR. This Phase 1 drill program was designed to confirm resources identified by previous drilling programs and expand these as well as trace the mineralization north and south along strike and at depth.

Additionally, detailed mine planning is well advanced to commence underground mining at San Andres, expected late this year (2022) to be followed soon after by milling. Planning for a Phase 2 RC drill program to upgrade resources and conduct even more detailed mine planning is in progress with drill pads already completed. San Andres is scheduled to be the second zone mined as part of the restart of mine operations at Punitaqui.

Exploration History

Prior to 1998, only limited extraction of high-grade copper oxides was undertaken at San Andres by small groups of local miners.

In 2000 a Chilean national company La Empressa Nacional de Mineria ("ENAMI") developed two underground exploration drives targeting copper sulphides.

In 2005, San Andres became part of the Punitaqui mine complex.

In 2007, a ground geophysical induced polarization ("IP") survey was completed on 250m - 500m spaced lines across the San Andres-Cinabrio area. The results of the IP survey line across the southern end of the San Andres zone identified a strong chargeability anomaly interpreted to represent potential extensions of the copper sulphide mineralization at depth and along strike.

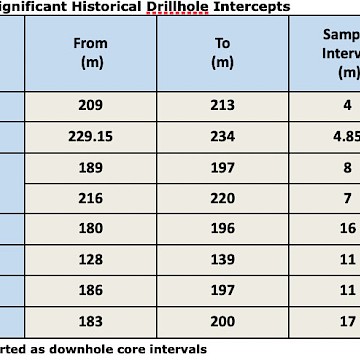

Historic wide-spaced drilling completed by the previous operators between 2011- 2017 totaled 58 holes for 5,927m. Significant intercepts reported included:

- SAS-20-07: 180m to 196m: 15.9m true width at 2.52% Cu

- SA-50: 128m to 139m: 7.8m true width at 2.39% Cu

- SAS-20-01: 186m to 197m: 10.1m true width at 2.16% Cu

- SAS-20-08: 183m to 200m: 15.2m true width at 1.74% Cu

Geology & Mineralization

The San Andres target is part of the Punitaqui project which is situated within a 25km long mineralized district that is a classic IOCG and mantos style Copper-Gold belt that is comprised of mantos and structural controlled Copper-Gold-Silver veins.

San Andres is a zone of Copper mineralization located 500m southwest of the high-grade Cinabrio deposit.

San Andres is a tabular sedimentary horizon within a volcanic sequence. This sedimentary horizon is variably mineralized and has a variable width ranging from 5m - 30m.

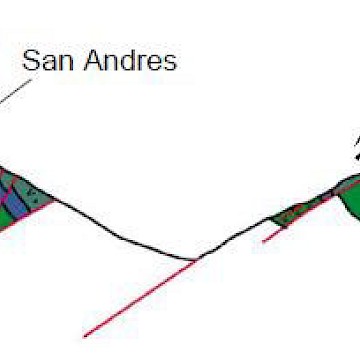

The horizon dips -40 to -50 degrees to the east and is cut-off at depth by the moderately west dipping San Andres fault.

The sedimentary horizon consists of an interlayered volcano-sedimentary sequence composed of dark colored laminated and unlaminated shales, volcanoclastic sandstone, conglomerates and breccias and tuff breccias. There is a variable component of syngenetic Pyrite.

The host horizon is also cut and offset by other faults with a wide range of orientations. The fundamental orientations identified to date include:

- moderately west dipping splays of the San Andres fault, generally with downward and westward movement

- steep dipping northeast to northwest trending faults with both sinistral and dextral offsets

The mineralisation is predominantly chalcopyrite and bornite. It consists of veinlets and irregular disseminations in both the fine and coarse-grained clastic rocks and locally within the volcanic rocks above and below the host unit.

The intersection of the host sedimentary unit and the San Andres fault plunges toward the south. Because of this, the potential volume of ore within the host sedimentary horizon increases towards the south.

The host sedimentary unit at San Andres is exposed along a north-northwest trending ridge. The surface trace of the mineralized unit crosses from the east side of the ridge in the northern part of San Andres to the western side of the ridge in the southern part.

Current BMR Exploration

The San Andres target is one of several historic zones identified by BMR with established underground access for infill and extensional drilling. San Andres is the "normal" fault displaced upper portion of the adjacent Cinabrio copper deposit.

San Andres is currently the focus of 8,000m phase 1 diamond drill program designed to confirm resources identified by previous drilling programs and expand these the mineralization north and south along strike and at depth.

As of end of December, a total of 8,156m of diamond core drilling in 38 drillholes have been completed.

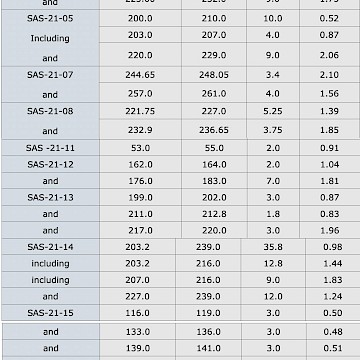

Thirty-three drillholes reached target depth and 28 have intersected significant sulphide mineralization. Sample results have been received for the first 8 drill holes. Encouraging results received to date include

- SAS-21-05: 9m at 2.06% Copper and 20.5 g/t Silver

- SAS-21-01: 3m grading 1.52% Copper and 2.0g/t silver

- SAS-21-03: 11m at 1.39% Copper including 8.00m at 1.63% Copper

- SAS-21-04: 16.7m grading 1.37% Copper including 11.70m at 1.64% Copper and a second interval of 9.00m at 1.75% Copper

- SAS-21-07: 3.4m at 2.10% Copper and a second interval of 4m at 1.56% Copper

- SAS-21-08: 5.25m at 1.39% Copper and a second interval of 3.75m at 1.85% Copper

- SAS-21-11: 2.0m at 0.91% Copper.

- SAS-21-12: 7.0m at 1.81% Copper and a second intercept of 2m grading 1.04% Copper.

- SAS-21-13: 3.0m at 1.96% Copper from 217m downhole, 3.0m grading 0.87% Copper from 199m and a third interval of 1.8m at 0.83% Copper from 211m.

- SAS-21-14: 28.1 m at 0.98% Copper from 203m downhole including 10.1m at 1.44% Cu and a second intercept of 9.4m grading 1.24% Copper from 227m.

- SAS-21-15: 3.0m at 0.5% Copper from 116m, 3.0m grading 0.48% Copper from 133m and a third interval of 2.0m at 0.51% Copper from 139m.

- SAS-21-17: 3.6m at 1.04% Copper from 241m.

- SAS-21-19: 5.0m at 1.08% Copper from 74m including 4.0m at 1.24% Copper.

- SAS-21-20: 2.4m at 0.70% Copper from 266.9m.

- SAS-21-21: 25.0m at 0.88% Copper from 106m including 13.0m at 0.96% Copper and 4.0m at 1.19% Copper from 115m and a second main intercept of 2.0m at 1.12% Copper from 136m.

- SAS-21-23: 2.8m at 1.00% Copper from 194m.

- SAS-21-24: 3.0m at 0.82% Copper from 231m.

A Phase 2 Infill drill RC drill program is being planned for later this year of ~15 holes totalling 2,400m.