Chile - Copper

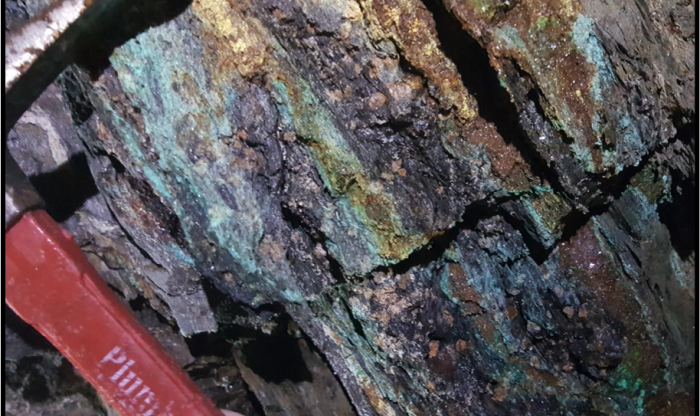

Our 100%-owned Punitaqui copper mine has been on care and maintenance since April 2020 when the previous operators we're forced into bankruptcy by its creditors due to the rapid fall in copper prices from mid-2018 to its bottom of $2.03/lb in March 2020.

The operation leverages excellent road access, ready availability of water, existing power lines, majority of operational permits in place, and widespread mineralization. Punitaqui boasts a nine-plus year operating history and is on track for resumption of underground mining in late 2022 followed by copper concentrate production soon after.

After acquiring the assets in March 2021, BMR was quick to begin redevelopment of the operation. The Company has recommenced activities for the resumption of mining and milling. Sale of copper concentrate will be carried out in conjunction with an aggressive two-phase regional exploration campaign to better define historical mineral resources and add new resources for mining in the future.

Cinabrio is the original underground mine which was the source of feed to the mill for over eight years and has remaining ore to be processed. The San Andres zone has existing underground access and copper mineralization up to 30 meters thick. The Dalmacia zone also has underground access and exhibits copper mineralization widths up to 50 meters. Regional targets including the Cinabrio Norte zone offer near-term “blue sky” exploration and district-scale potential for BMR.

The re-start of mine operations is projected to begin late 2022 with full commissioning expected shortly after. Punitaqui has the potential to generate an annual EBITDA of up to US$50 million at or above a copper price of $4.00/lb.

Punitaqui - Key Targets

Canada - Cobalt/Silver

BMR was one of the first current explorers to recognize the potential for new high-grade primary cobalt discoveries in the Cobalt Ontario region. Between 2016 and April 2018 BMR acquired through claim staking, option, joint venture, and direct purchase the largest regional land holding in the Cobalt district (15 projects consisting of 8,665 claims / 1,895.6 km2). BMR's property holdings are in the historic home of high-grade cobalt-silver veins in Canada known locally as the Cobalt Embayment.

Three historic mining camps were developed during the past century including the main Cobalt camp, the Gowganda and Elk Lake camps. The Cobalt Embayment is home to over 800 cobalt-silver occurrences as well as numerous copper, zinc, nickel, and gold prospects. A total of 70 mines were developed that produced over 525M oz. of silver and 50M lb. of cobalt from 1904 -1985. The key driver in this ground acquisition was a focus on outcropping, high-grade cobalt-silver occurrences, and past producing mines. Field geotechnical assessments and assay results of samples from outcrop have revealed target prospects that range from 1% to >10% cobalt.

At Gowganda, BMR is the largest land holder and the company's leases host three of the four main historic silver-cobalt past producing mines; Bonsall, Miller Lake-O'Brien and Capitol. BMR's Gowganda holdings host 37 historical workings or mineral occurrences. At Elk Lake, all the known historic mining areas and significant silver-cobalt occurrences are held by BMR.

The key achievement to date was the 63 drillholes (11,631m) completed to delineate our first high-grade cobalt resource on the McAra Property in late 2019. The McAra deposit currently hosts a measured and indicated resource of 1.1M lb. of high-grade cobalt grade of 1.47% (underground mineral resources are reported at a cut-off grade of 0.75% Co Eq. Cut-off grades are based on a price of US$16 per Ib. of cobalt US$17 per oz. silver and assumed recoveries of 100% for underground resources). See SRK Technical Report on Cobalt Exploration Assets in Canada, October 31, 2020, on SEDAR and on our website for more.

BMR's exploration effort consists of a multi-faceted approach using geological, structural, geochemical, and geophysical data to identify and assess targets. Airborne magnetic-radiometric (26,709 Line Km) and LIDAR topographic surveys (1,325 square km) were flown over all of the Company's holdings. A detailed Airborne Electromagnetic (VTEM) was flown over the McAra – Wilder properties. Ground follow-up geophysical surveys (magnetics & induced polarization) over higher priority targets comprised of 515 line-kilometres of data collection.

Between 2016 and year-end 2020 a major focus was on ground follow-up and field assessments that resulted in the collection of 825 rock and soil samples for geochemical analysis. During 2020 alone, field assessments of 355 mineral occurrences on seven of our project areas was completed. Activities included prospecting, rock sampling and detailed geological mapping.

Since 2017, BMR has drilled 412 holes / 51,452m focussed on 23 target areas within eight projects. As of June 2022, BMR controls a land package totalling ten properties, 5,368 tenements that encompass an area of 102,487 hectares / 1,025km2 in the Ontario-Quebec Cobalt Belt. The key projects within the land package include McAra, Gowganda, Elk Lake, Fabre, and Wilder.

Idaho Cobalt

Battery Minerals Resources holds the Bonanza, Desert and East Fork properties located in the historic cobalt-copper-gold Blackbird mining district approximately 30 kilometers west of Salmon, Idaho. The three properties cover fourteen significant cobalt prospects within the known cobalt-copper-gold mineralized zone.

The Bonanza property has been BMR's main exploration focus in Idaho and hosts drill ready targets located adjacent to the Jervois Global Ram Deposit / Idaho Cobalt Works that hosts a Reserve of 2.5 million tonnes grading 0.55% cobalt, 0.8% copper and 0.64g/t gold for 30M lb. of contained cobalt. The Idaho Cobalt Works is the only primary cobalt mine in America set for production in late 2022. BMR’s Bonanza property exhibits similar geology to the Idaho Cobalt Works deposit and hosts multiple surface and sub-surface shoots of cobalt-copper-gold mineralization hosted along a contact with a gabbro sill.

Historic drilling results demonstrated cobalt grades ranging 0.4% to 0.58% with anomalous gold from surface level to 100 meters deep. All projects three BMR Idaho cobalt belt properties host excellent high-grade cobalt-copper-gold discovery potential.

South Korea - Graphite

Historically, South Korea was a major supplier of graphite to world markets. From 1970 - 1990 South Korea was the largest producer of graphite, outside of China, producing about 77 000tpa of flake and amorphous graphite annually.

BMR has 100% ownership of the Guemam and Taehwa graphite exploration projects containing high-purity flake graphite deposits. Both assets are past-producing mines with existing local infrastructure and near-term production potential. The Guemam project contains three mining rights and six exploration rights for a combined area of 604 hectares, while the Taewha project contains one mining right covering 67 hectares. Both projects are close to infrastructure as South Korea is a very densely populated country.

The Guemam project is the more advanced of the two and boasts a 43-101 compliant indicated resource of 2.6M tonnes at 6/6% graphite containing 101,000 tonnes of graphite as well as an inferred resource of 5.6M tonnes at 5.5% graphite containing 306,000 tonnes of graphite.

Nevada Lithium

Our Amargosa lithium project is in the southern Basin & Range province and central Mojave Desert of Nevada. The Amargosa property is a hydro-geological sink, surrounded by lithium leaching volcanics which is a similar setting to the nearby Clayton Valley lithium deposit, which is currently undergoing a feasibility study and owned by Cypress Development Corp. that hosts an indicated resource of 1,304.2Mt grading 905 ppm lithium (containing 1,179.9M kg of lithium) and inferred resource of 236.4Mt grading 759.9 ppm lithium (containing 179.6M kg lithium). *See NI 43-101 Clayton Valley Technical Report, Cypress Development Corp. BMR's Amargosa project is an early-stage exploration opportunity in a favourable region that hosts numerous lithium occurrences, including the Clayton Valley lithium deposit owned by Cypress Development Corp., as well as a major nearby lithium brine mine currently in production called the Silver Peak mine held by Albermarle Corp., one of the world's largest lithium producers. The Silver Peak operation is recognized as the only producing lithium brine mine in North America.